27+ how reverse mortgage works

Ad How Does A Reverse Mortgage Work. Get A Free Information Kit.

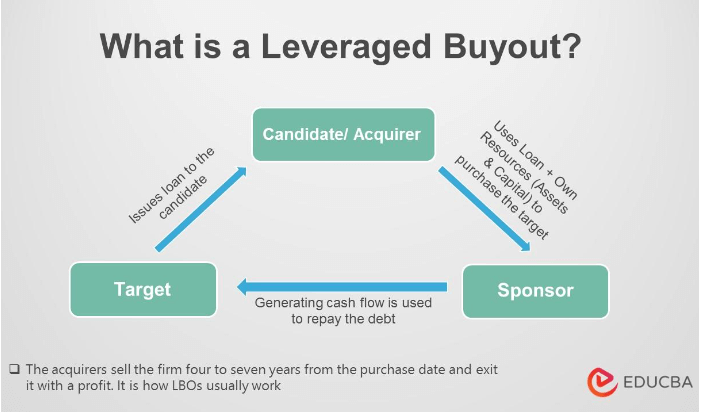

Leveraged Buyout Characteristics Ratios To Determine Lbo Candidate

Ad Compare the Best Reverse Mortgage Lenders.

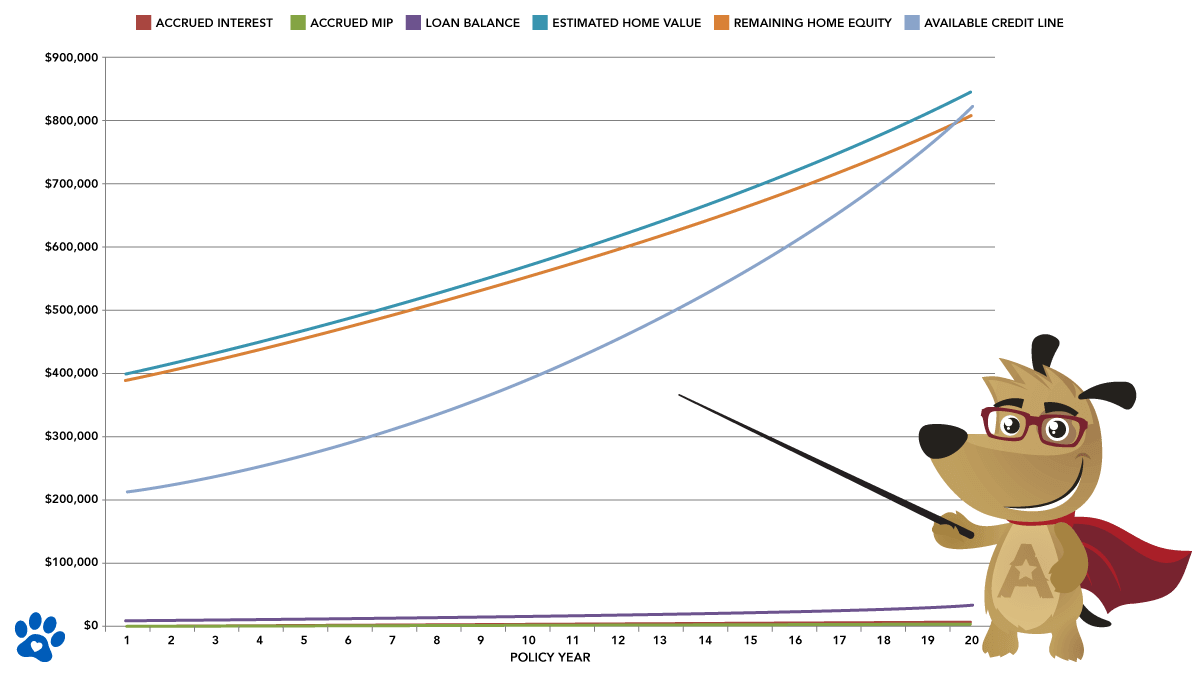

. Web A reverse mortgage can be an expensive way to borrow. After that the premium is 05 of the. Web A reverse mortgage works by using a portion of your home equity to first pay off your existing mortgage on the home that is if you still have a mortgage.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Shared Equity May Be The Best Solution. Its for people who have gained equity in their home since originally buying it and likely have paid off their.

The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or. Web A reverse mortgage is a loan for homeowners 62 and up with a large amount of home equity. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. A reverse mortgage lender. Try Our Free Calculator To Receive a General Estimate If You Are Eligible.

Learn More See If You Qualify. You can typically get a lump sum monthly payments or a line of credit. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

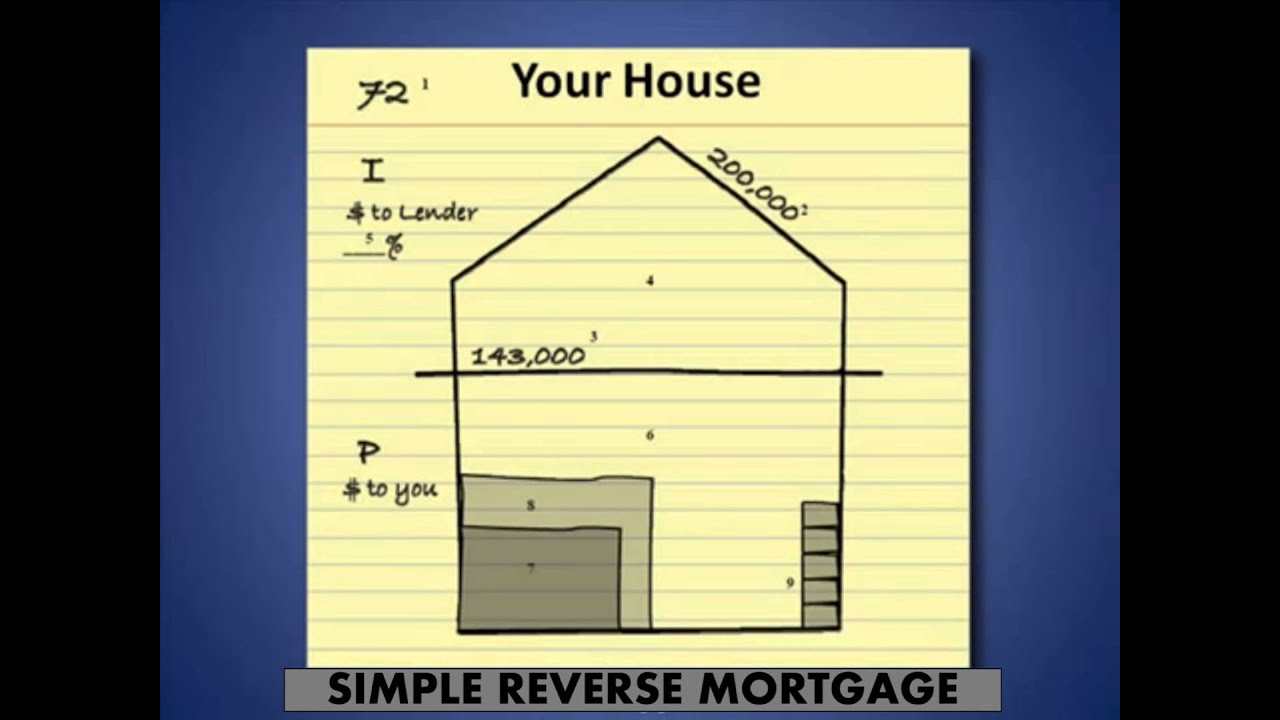

Web The borrower must pay an initial one-time premium for the FHA insurance equal to 2 of the loan amount. A reverse mortgage allows homeowners who are 62 and older to withdraw the equity from their homes. Get A Free Information Kit.

Web In this video USA Reverse addresses how a reverse mortgage works. Web Key Takeaways. Ad Our Reviews and Recommendations Are Trusted By 45000000 Customers.

Web For instance you might be able to use a single-purpose reverse mortgage only to pay your property taxes or to make improvements to the home. It can be paid to you in one lump sum as a regular monthly income or at. Web A reverse mortgage is a home loan that you do not have to pay back for as long as you live in your home.

Ad No Monthly Payments. Ad Compare the Best Reverse Mortgage Lenders. Reverse mortgages may very well be the most unique of all mortgage types.

Web A reverse mortgage is a type of home loan for people age 62 or older. The homeowner can borrow money from a lender against the value of their home. For Homeowners Age 61.

Way Easier Than A Reverse Mortgage. For Homeowners Age 61. Web Up to 25 cash back Proprietary reverse mortgages work similarly to HECMs.

Web At its simplest a reverse mortgage is a mortgage loan that works in reverse. Web When you take out a conventional mortgage youll make monthly principal and interest payments to the lender over a period of 10 15 20 or 30 years. Compare a Reverse Mortgage with Traditional Home Equity Loans.

You can receive your money though a line. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. For Homeowners Age 61.

For Homeowners Age 61.

What Is A Reverse Mortgage How Does It Work Arlo

Everything You Need To Know About Reverse Mortgages Bankrate

How Reverse Mortgages Work Payouts Functions Costs

Reverse Mortgage A Clear Concise Guide To How It Works Youtube

Solved How Does A Reverse Mortgage Work Bob Vila

How Does A Reverse Mortgage Work Youtube

How Reverse Mortgages Work Howstuffworks

What Is A Reverse Mortgage How Does It Work Arlo

What Is A Reverse Mortgage How Does It Work Arlo

Reverse Mortgages How They Work And Who They Re Good For Forbes Advisor

:max_bytes(150000):strip_icc()/shutterstock_106623704-5bfc3695c9e77c00519d1585.jpg)

Reverse Mortgage Guide With Types And Requirements

What Is A Reverse Mortgage Things You Need To Know

Reverse Mortgage Calculator

What Is A Reverse Mortgage How Does It Work Arlo

Is A Reverse Mortgage Right For You Trusted Choice

Reverse Mortgage Net

How Reverse Mortgages Work Payouts Functions Costs